Low Rates.

Our rates are low, our application is quick and easy! We can get you clear to close in as little as 10 days!

Trusted By Agents With

Meet Bill Rapp

NMLS ID # NMLS # 228246

William Rapp, based in Houston, TX, US, is currently a Capital Advisor at Medallion Funds, bringing experience from previous roles at eXp Commercial, NEXA Mortgage, Viking Enterprise LLC and Sun Realty - Houston. William Rapp holds a 1997 - 2001 BBA in Finance @ Texas A&M University. With a robust skill set that includes REO, Sellers, SFR, FHA financing, Reverse Mortgages and more, William Rapp contributes valuable insights to the industry.

The Client Experience

Great experience purchasing our first home! Bill was easy to reach and always able to answer any questions or concerns.

Blogs

The Top 5 Mortgage Mistakes to Avoid

Buying your first home can be both exciting and nerve-wracking at the same time. With so many things to consider and....

Mortgage Do and

Do not list

Mortgages can be tricky, and it's easy to make mistakes that can end up costing you dearly. That's why we've put together this list....

Tips On How To Improve Your Credit Score

Let's talk about some ways you can improve your credit score! Your credit score is actually a big deal, and it can affect...

💡 Creative Financing Strategies for Developers 🏗️ | How Investment GUC Loans Fund Horizontal & Vertical Construction

💡 Creative Financing Strategies for Developers: How Investment GUC Loans Power Ground-Up Construction In today’s development environment, traditional bank construction loans often move too slowly or... ...more

Bill Rapp, Commercial Mortgage Broker

January 30, 2026•2 min read

🏭📈 Texas Manufacturing Boom Is Fueling Houston & Katy Commercial Real Estate Demand

Texas Manufacturing Momentum Is Reshaping Houston-Area Commercial Real Estate Texas has emerged as one of the clearest winners of the U.S. manufacturing re-shoring movement, and Houston sits at the e... ...more

Bill Rapp, Commercial Mortgage Broker

January 29, 2026•2 min read

🏦📈 Regional Banks Are Back in CRE Lending — What It Means for Smart Borrowers in 2026

Regional Banks Are Quietly Re-Entering CRE Lending — And the Math Finally Works Again After nearly three years of retrenchment, regional banks are cautiously re-entering the commercial real estate (C... ...more

Bill Rapp, Commercial Mortgage Broker

January 28, 2026•2 min read

🏡📘 The Smart Guide to Buying Your First Home — The No-Nonsense Playbook Every First-Time Buyer Needs

The Smart Way to Buy Your First Home—Without Guesswork Buying your first home is one of the most important financial decisions you will ever make. Unfortunately, most first-time buyers enter the proc... ...more

Bill Rapp, Commercial Mortgage Broker

January 27, 2026•2 min read

🙏 Faith & Mortgage Brokerage: Serving Clients With Integrity, Not Pressure 🏡

Faith and Mortgage Brokerage: Serving Clients Through a Higher Calling Mortgage brokerage is often viewed as a transactional business—rates, terms, and approvals. But for me, it is something much dee... ...more

Bill Rapp, Commercial Mortgage Broker

January 27, 2026•3 min read

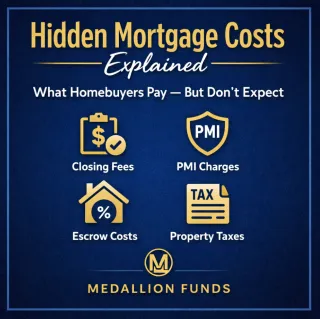

💰 Hidden Costs in Mortgages That Catch Homebuyers Off Guard 🏠

Hidden Costs in Mortgage & Homebuying (And How to Avoid Them) Buying a home isn’t just about the purchase price or interest rate. Many borrowers are surprised to discover thousands of dollars in hidd... ...more

Bill Rapp, Commercial Mortgage Broker

January 27, 2026•3 min read

10 Tips for First-Time Homebuyers

Buying your first home can be both exciting and nerve-wracking at the same time. With so many things to consider and....

How To Choose the Right Lender for You

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy

Refinancing youe loan and when to do it

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy

Copyright ©2021 | Mortgage Viking Team

Licensed to Do Business | NMLS # 228246

This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Copyright © 2021 | Medallion Funds

Corporate | NMLS ID NMLS # 1825831

Corporate Address : 2651 N. Green Valley Pkwy STE. 101 Henderson, NV 89014

Corporate NMLS NMLS # 1825831 | Company Website: https://medallionfunds.com/bill-rapp/

Copyright ©2021 | Mortgage Viking Team Licensed to Do Business | NMLS # 228246

This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply

Corporate | NMLS ID NMLS # 1825831

Corporate Address : 2651 N. Green Valley Pkwy STE. 101 Henderson, NV 89014 https://medallionfunds.com/bill-rapp/

Facebook

Instagram

X

LinkedIn

Youtube

TikTok