Low Rates.

Our rates are low, our application is quick and easy! We can get you clear to close in as little as 10 days!

Trusted By Agents With

Meet Bill Rapp

NMLS ID # NMLS # 228246

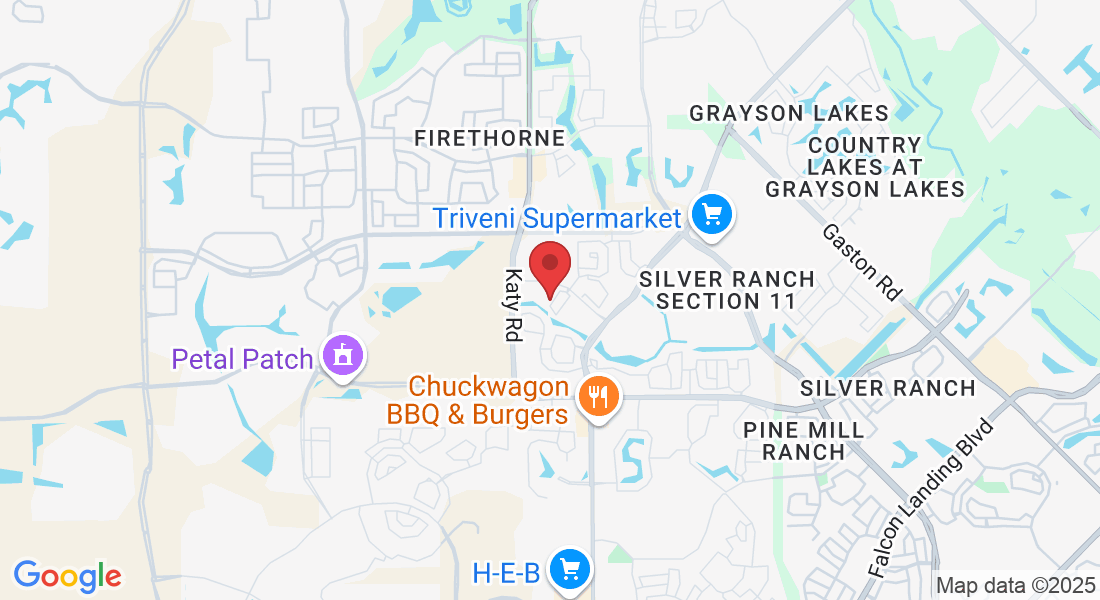

William Rapp, based in Houston, TX, US, is currently a Capital Advisor at Medallion Funds, bringing experience from previous roles at eXp Commercial, NEXA Mortgage, Viking Enterprise LLC and Sun Realty - Houston. William Rapp holds a 1997 - 2001 BBA in Finance @ Texas A&M University. With a robust skill set that includes REO, Sellers, SFR, FHA financing, Reverse Mortgages and more, William Rapp contributes valuable insights to the industry.

The Client Experience

Great experience purchasing our first home! Bill was easy to reach and always able to answer any questions or concerns.

Blogs

The Top 5 Mortgage Mistakes to Avoid

Buying your first home can be both exciting and nerve-wracking at the same time. With so many things to consider and....

Mortgage Do and

Do not list

Mortgages can be tricky, and it's easy to make mistakes that can end up costing you dearly. That's why we've put together this list....

Tips On How To Improve Your Credit Score

Let's talk about some ways you can improve your credit score! Your credit score is actually a big deal, and it can affect...

💰 CRE Comeback: Office Buildings Selling at Huge Discounts! 💰

💰 CRE Comeback: Office Buildings Selling at Huge Discounts! 💰

📉 Office Market: Why Investors Are Buying at 83% Discounts! 📉

For the past few years, Chicago’s office market has been, let’s just say… a tough sell. High interest rates, political uncertainty, and growing crime concerns had many investors sitting on the sidelines, watching buildings struggle with vacancies and dropping valuations. But now? Things are shifting—and fast.

In a surprising turn, we’ve seen four major office deals close or approach closing in just the past few weeks. And they aren’t just small transactions—these are deep-discount acquisitions that have caught the attention of opportunistic buyers. The key question: Why now? Let’s break it down.👇

💰 A Reset in Pricing—Bargain Hunting Begins

According to Andrew Brog of Brog Properties, the reset in Chicago office pricing is undeniable. His firm just scooped up a 16-story office building at 550 W. Washington Blvd. for a jaw-dropping $18.5M in all cash—a staggering 83% discount from the $111M price tag MetLife paid in 2013 when it was fully leased.

His take? Investors who aren’t from Chicago have an advantage because they aren’t emotionally attached to the pain of the last few years. They see the numbers, not just the struggles.

"You can't be from Chicago and be buying these buildings," Brog said.

"Or if you are from Chicago, you have to have never owned an office building in Chicago. And why? Because you can't see the opportunity, because you're going through pain.”

Translation: Outside investors smell blood in the water and they’re ready to pounce. 🦈

🏗️ The Value is in the Steel and Glass

Another big move? A joint venture between 601W Cos. and David Werner Real Estate Investments just picked up 303 E. Wacker for $63M—a whopping 66% drop from its 2018 price of $182M.

Ran Eliasaf of Northwind Group, which financed the deal, put it bluntly:

👉 “At a $35 per square foot basis, we feel comfortable with almost any building. Basically, the value of the glass and the steel is more.”

In simple terms: When a building’s price drops so low that the physical materials it’s made from are arguably worth more than the purchase price, investors start paying attention. 🤯

🏢 What’s Next for Chicago’s Office Market?

Despite these big plays, not every investor is convinced this is the start of a full-blown rebound. Eliasaf, for example, called his firm’s Wacker Drive deal a “one-off”—a rare moment where every factor aligned perfectly:

✅ Strong location

✅ Reliable cash flow

✅ Good tenancy mix (no over-reliance on one major tenant)

✅ Experienced buyers who have done multiple deals with Northwind before

That said, Brog is all-in on the idea that Chicago’s office market is on the verge of a comeback. He already owns two other office properties in the city and is looking for his next deal in the Central Loop. His strategy?

🚀 Upgrading amenities

🏗️ Doing build-to-suit deals

📉 Offering competitive rates thanks to the low-cost acquisition

📈 Why Some Investors Are Betting Big on Chicago

It’s not just about cheap deals—it’s about Chicago itself. Brog believes the city’s fundamentals remain strong:

🧑🎓 A steady pipeline of talent from Big Ten universities

🏙️ A prime location as the economic hub of the Midwest

🏢 A beautiful, architecturally rich office market that will always have demand

“Chicago is always going to be the center of the Midwest, the hub of the Midwest,” Brog said. “I don't think that's ever going to change.”

Final Thoughts: Is This the Bottom for Chicago’s Office Market?

If recent deals are any indicator, some investors believe we’ve hit rock bottom—and they’re making moves before prices climb again. The city’s office sector isn’t out of the woods yet, but for those with cash and a long-term vision, Chicago might just be the ultimate contrarian bet.

So, what do you think? Are investors making the right move by jumping in now, or is it still too soon to call a real recovery?

Drop your thoughts in the comments! 👇💬

#ChicagoRealEstate #CRE #OfficeMarket #Investing #ChicagoCRE #CommercialRealEstate 🚀🏙️

Looking to buy, sell, or finance commercial real estate?

Work with an experienced Commercial Real Estate & Mortgage Broker you can trust!

Call me at 281-222-0433 today!

https://www.billrapponline.com/

https://medallionfunds.com/bill-rapp/

https://billrapp.commloan.com/

https://houstoncommercialmortgage.com/

https://findamortgagebroker.com/Profile/WilliamRappJr28883

https://billrapponline.com/financingfuturescre-houston-katy

https://www.smartbizloans.com/partner/vikingenterprisellc/bill

https://doctorvideo.billrapponline.com/

https://veteransvideo.billrapponline.com/

https://mortgageviking.billrapponline.com/

https://fha203h.billrapponline.com/

https://renovationvideo.billrapponline.com/

© 2023-2024 Bill Rapp, Medallion Funds LLC, Director of Capital Advisory

#ChicagoCRE #RealEstateTrends 🚀

10 Tips for First-Time Homebuyers

Buying your first home can be both exciting and nerve-wracking at the same time. With so many things to consider and....

How To Choose the Right Lender for You

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy

Refinancing youe loan and when to do it

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy

Copyright ©2021 | Mortgage Viking Team

Licensed to Do Business | NMLS # 228246

This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Copyright © 2021 | Medallion Funds

Corporate | NMLS ID NMLS # 1825831

Corporate Address : 2651 N. Green Valley Pkwy STE. 101 Henderson, NV 89014

Corporate NMLS NMLS # 1825831 | Company Website: https://medallionfunds.com/bill-rapp/

Copyright ©2021 | Mortgage Viking Team Licensed to Do Business | NMLS # 228246

This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply

Corporate | NMLS ID NMLS # 1825831

Corporate Address : 2651 N. Green Valley Pkwy STE. 101 Henderson, NV 89014 https://medallionfunds.com/bill-rapp/

Facebook

Instagram

X

LinkedIn

Youtube

TikTok