Low Rates.

Our rates are low, our application is quick and easy! We can get you clear to close in as little as 10 days!

Trusted By Agents With

Meet Bill Rapp

NMLS ID # NMLS # 228246

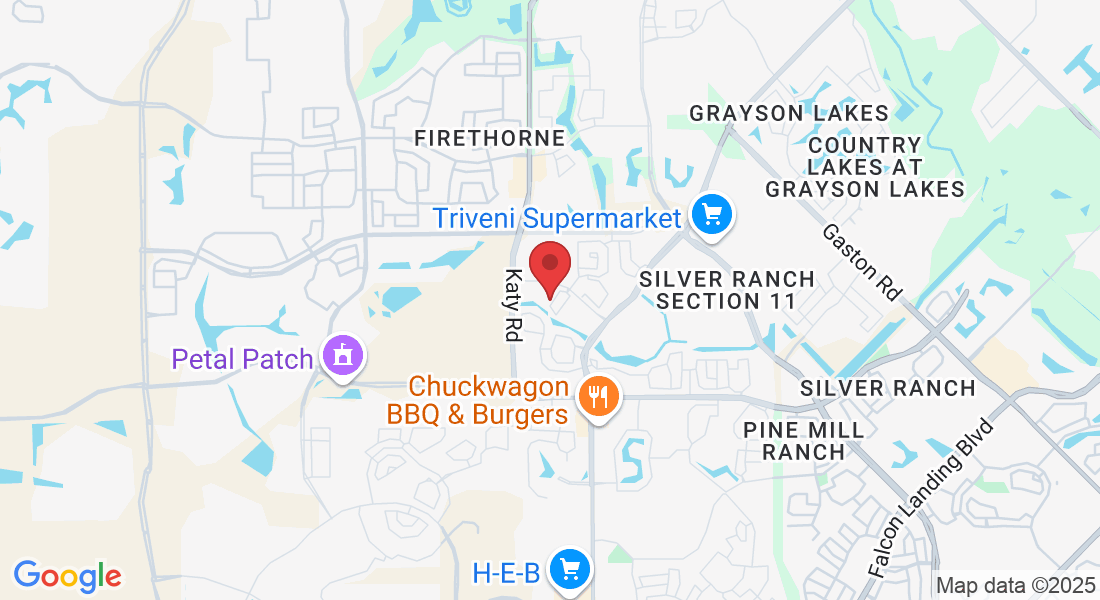

William Rapp, based in Houston, TX, US, is currently a Capital Advisor at Medallion Funds, bringing experience from previous roles at eXp Commercial, NEXA Mortgage, Viking Enterprise LLC and Sun Realty - Houston. William Rapp holds a 1997 - 2001 BBA in Finance @ Texas A&M University. With a robust skill set that includes REO, Sellers, SFR, FHA financing, Reverse Mortgages and more, William Rapp contributes valuable insights to the industry.

The Client Experience

Great experience purchasing our first home! Bill was easy to reach and always able to answer any questions or concerns.

Blogs

The Top 5 Mortgage Mistakes to Avoid

Buying your first home can be both exciting and nerve-wracking at the same time. With so many things to consider and....

Mortgage Do and

Do not list

Mortgages can be tricky, and it's easy to make mistakes that can end up costing you dearly. That's why we've put together this list....

Tips On How To Improve Your Credit Score

Let's talk about some ways you can improve your credit score! Your credit score is actually a big deal, and it can affect...

🚨 Houston CRE Controversy: Millions Diverted from Housing to Empty Offices! 🏢💰

🚨 Houston CRE Controversy: Millions Diverted from Housing to Empty Offices! 🏢💰

💰 Where Did the Money Go? Houston’s Affordable Housing Funds Mismanaged 🤯🏡

Houston’s Midtown Redevelopment Authority had a vision—a bold plan to curb gentrification and bring much-needed affordable housing to the historic Third Ward. The strategy? Purchase hundreds of lots, slow down displacement, and create opportunities for low-income families.

Sounds great, right? Well, here’s where things take a turn. Instead of funneling the majority of those funds directly into housing, the largest single expense from their affordable housing budget wasn’t homes at all—it was a half-empty office building. 🤯

An Office Tower Where Nobody Lives 🏢❌

Let’s be real—when you hear “affordable housing funds,” you probably imagine homes, not commercial office space. But in this case, the Midtown Redevelopment Authority thought differently. They built a brand-new office tower with the idea that it would be a hub for nonprofits dedicated to housing. The concept was simple:

🔹 A one-stop shop where families in need could apply for housing assistance, find resources, and connect with programs.

🔹 Affordable rent for nonprofit organizations dedicated to helping the community.

🔹 A ground floor full of retail, providing much-needed business space for local entrepreneurs.

But here’s the reality:

❌ The building sits mostly empty.

❌ The rent is too high for many local nonprofits to afford.

❌ The ground floor retail? Never happened. Instead, they leased the space to a health clinic that closed in 2023 but is still paying rent until 2028.

Where Did the Money Go? 💸🤷♂️

This isn’t just about one office building—it’s part of a bigger issue. While the Authority has built some affordable housing, it still owns hundreds of vacant lots that sit untouched and overgrown.

Meanwhile, there’s been major financial mismanagement, with former officials facing felony charges for allegedly misusing $8.5 million in affordable housing funds.

Here’s what happened:

🔹 A former Midtown executive was paying a company he secretly owned.

🔹 He was also in a romantic relationship with one of the biggest vendors, who was paid for work that was never done.

🔹 Money that was meant for maintaining and developing housing was essentially funneled into personal pockets.

What’s Next for Midtown’s Housing Efforts? 🔮🏡

Despite all of this, the Midtown Redevelopment Authority still owns a massive amount of land—land that could be used for affordable housing right now.

The plan moving forward?

🔹 Selling small groups of lots to homebuilders who will create income-restricted homes.

🔹 Continuing to work with nonprofits to develop multifamily housing.

🔹 Figuring out what to do with that half-empty office tower and the retail space that was promised but never delivered.

The big question remains: Will they actually fulfill their mission, or will this be yet another chapter of wasted opportunities?

Final Thoughts: A Community Left Waiting ⏳

The Third Ward community was promised affordable housing, retail space, and a community gathering hub—but instead, they got an office building that’s not being used as intended.

Local leaders are frustrated. Residents are frustrated. And those who invested their trust in this initiative are left wondering: When will real change happen?

One thing’s for sure—Houston can’t afford more broken promises. 🏠💔

What do you think? Should the city repurpose the office space? Should there be more oversight on affordable housing funds?

Drop your thoughts in the comments! 👇

#HoustonRealEstate #AffordableHousing #CRENews #HoustonDevelopment #CommunityRevitalization

Looking to buy, sell, or finance commercial real estate?

Work with an experienced Commercial Real Estate & Mortgage Broker you can trust!

Call me at 281-222-0433 today!

https://www.billrapponline.com/

https://medallionfunds.com/bill-rapp/

https://billrapp.commloan.com/

https://houstoncommercialmortgage.com/

https://findamortgagebroker.com/Profile/WilliamRappJr28883

https://billrapponline.com/financingfuturescre-houston-katy

https://www.smartbizloans.com/partner/vikingenterprisellc/bill

https://doctorvideo.billrapponline.com/

https://veteransvideo.billrapponline.com/

https://mortgageviking.billrapponline.com/

https://fha203h.billrapponline.com/

https://renovationvideo.billrapponline.com/

© 2023-2024 Bill Rapp, Medallion Funds LLC, Director of Capital Advisory

10 Tips for First-Time Homebuyers

Buying your first home can be both exciting and nerve-wracking at the same time. With so many things to consider and....

How To Choose the Right Lender for You

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy

Refinancing youe loan and when to do it

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy

Copyright ©2021 | Mortgage Viking Team

Licensed to Do Business | NMLS # 228246

This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Copyright © 2021 | Medallion Funds

Corporate | NMLS ID NMLS # 1825831

Corporate Address : 2651 N. Green Valley Pkwy STE. 101 Henderson, NV 89014

Corporate NMLS NMLS # 1825831 | Company Website: https://medallionfunds.com/bill-rapp/

Copyright ©2021 | Mortgage Viking Team Licensed to Do Business | NMLS # 228246

This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply

Corporate | NMLS ID NMLS # 1825831

Corporate Address : 2651 N. Green Valley Pkwy STE. 101 Henderson, NV 89014 https://medallionfunds.com/bill-rapp/

Facebook

Instagram

X

LinkedIn

Youtube

TikTok