Low Rates.

Our rates are low, our application is quick and easy! We can get you clear to close in as little as 10 days!

Trusted By Agents With

Meet Bill Rapp

NMLS ID # NMLS # 228246

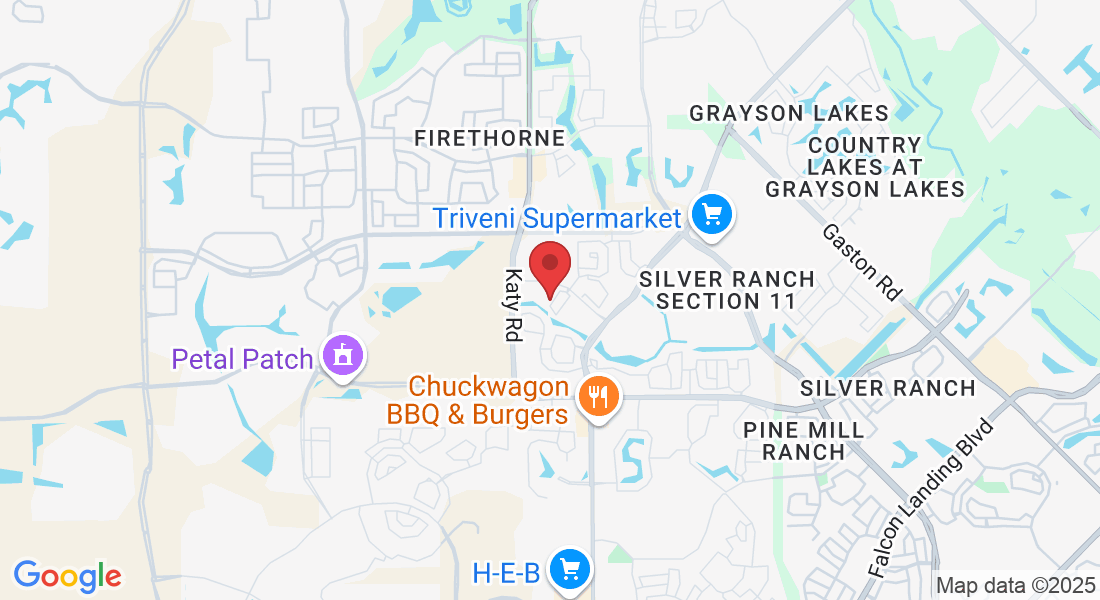

William Rapp, based in Houston, TX, US, is currently a Capital Advisor at Medallion Funds, bringing experience from previous roles at eXp Commercial, NEXA Mortgage, Viking Enterprise LLC and Sun Realty - Houston. William Rapp holds a 1997 - 2001 BBA in Finance @ Texas A&M University. With a robust skill set that includes REO, Sellers, SFR, FHA financing, Reverse Mortgages and more, William Rapp contributes valuable insights to the industry.

The Client Experience

Great experience purchasing our first home! Bill was easy to reach and always able to answer any questions or concerns.

Blogs

The Top 5 Mortgage Mistakes to Avoid

Buying your first home can be both exciting and nerve-wracking at the same time. With so many things to consider and....

Mortgage Do and

Do not list

Mortgages can be tricky, and it's easy to make mistakes that can end up costing you dearly. That's why we've put together this list....

Tips On How To Improve Your Credit Score

Let's talk about some ways you can improve your credit score! Your credit score is actually a big deal, and it can affect...

📈 Industrial, Office, Retail & Multifamily: CRE’s 2025 Bright Spots 🏙️

📈 Industrial, Office, Retail & Multifamily: CRE’s 2025 Bright Spots 🏙️

💼 How CRE Market Trends Shape Multifamily & Retail in 2025 🏠

Hey there, CRE enthusiasts! Let’s chat about some intriguing insights from Moody’s latest sector-by-sector analysis. It seems 2025 might be the year the commercial real estate industry finally finds its footing. While not every sector is thriving, there’s enough optimism to go around, with each sector charting its unique path to equilibrium.

Multifamily: Steady Demand Balances Supply Shocks 🏢

First up, the multifamily sector. Moody’s describes its second-half performance as balanced, which feels like a rare word in the real estate world these days! With 300,000 new units completed across 79 major metros, vacancy rates have crept up slightly to 6.1%—the highest since 2011.

So, what’s holding it all together? Population growth, fueled by a rapid recovery in immigration, and a tight single-family housing inventory. People simply aren’t ready to leave the rental market, which is great news for multifamily owners.

Rents continue to climb, albeit modestly, with the national asking rent closing 2024 at $1,850. Class A inventory is driving competition, and longer lease-up times have introduced concessions into the mix. It’s a give-and-take market, but renters and landlords seem to be coexisting in harmony for now.

Office: Struggling, But Signs of Stability 🏢💻

Ah, the office sector—our post-pandemic wildcard. The national office vacancy rate hit a record high of 20.4% in Q4 2024. Ouch. Effective rents barely budged, increasing by just 0.1%.

Still, there’s hope. More firms are leaning into in-person workdays, and return-to-office rates are stabilizing. The trend toward newer buildings designed for collaboration over cubicles is redefining the “flight to quality” narrative. With 17.5M square feet of new construction in 2024—still below pre-pandemic levels—there’s a cautious optimism that office spaces will eventually align with new work models.

Retail: Steady as She Goes 🛍️

Retail, you sly devil. While other sectors wrestled with volatility, retail vacancy remained rock solid at 10.3% in Q4. Asking rents nudged up to $21.90 per square foot, while effective rents reached $19.19.

This stability is largely thanks to resilient retail sales, bolstered by robust household finances, a cooling inflation rate, and those oh-so-helpful Federal Reserve interest rate cuts. Consumers are still spending, particularly on motor vehicles and online merchandise, keeping the sector buoyant.

Industrial: Still the Post-Pandemic Star 🌟

And then there’s industrial—our MVP. Vacancy rates dipped to 6.9%, below pre-pandemic levels. While new construction starts have slowed, some delayed projects could re-enter the pipeline, potentially nudging vacancy rates up.

Rents continue to grow, though at a slower pace, with both asking and effective rents increasing by 0.3% in Q4. It’s clear that industrial real estate remains a bright spot, driven by strong demand and a more cautious approach to new builds.

What’s Next?

So, where does this leave us? Each sector has its challenges, but collectively, they’re inching toward a new normal. Whether it’s multifamily’s balanced act, retail’s quiet resilience, industrial’s continued dominance, or the office sector’s slow reinvention, the commercial real estate market is finding its rhythm.

2025 might not be the year of explosive growth, but it could be the year we look back on as the moment CRE found its groove. What do you think—are we on the brink of balance, or is there still turbulence ahead? Let’s discuss!

#CRE #RealEstateTrends #Multifamily #IndustrialRealEstate #RetailGrowth #OfficeSpaces #MarketEquilibrium

I’m an experienced Commercial Real Estate Mortgage Broker, please feel free to reach me at 281-222-0433.

https://www.billrapponline.com/

https://medallionfunds.com/bill-rapp/

https://houstoncommercialmortgage.com/

https://findamortgagebroker.com/Profile/WilliamRappJr28883

https://doctorvideo.billrapponline.com/

https://veteransvideo.billrapponline.com/

https://mortgageviking.billrapponline.com/

https://fha203h.billrapponline.com/

https://renovationvideo.billrapponline.com/

https://www.smartbizloans.com/partner/vikingenterprisellc/bill

https://www.fastexpert.com/loan-officer/bill-rapp-95119/

https://billrapponline.com/financingfuturescre-houston-katy

https://www.smartbizloans.com/assist/partner/medallionfunds/bill

https://billrapp.commloan.com/

© 2023-2024 Bill Rapp, Medallion Funds LLC, Director of Capital Advisory

10 Tips for First-Time Homebuyers

Buying your first home can be both exciting and nerve-wracking at the same time. With so many things to consider and....

How To Choose the Right Lender for You

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy

Refinancing youe loan and when to do it

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy

Copyright ©2021 | Mortgage Viking Team

Licensed to Do Business | NMLS # 228246

This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Copyright © 2021 | Medallion Funds

Corporate | NMLS ID NMLS # 1825831

Corporate Address : 2651 N. Green Valley Pkwy STE. 101 Henderson, NV 89014

Corporate NMLS NMLS # 1825831 | Company Website: https://medallionfunds.com/bill-rapp/

Copyright ©2021 | Mortgage Viking Team Licensed to Do Business | NMLS # 228246

This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply

Corporate | NMLS ID NMLS # 1825831

Corporate Address : 2651 N. Green Valley Pkwy STE. 101 Henderson, NV 89014 https://medallionfunds.com/bill-rapp/

Facebook

Instagram

X

LinkedIn

Youtube

TikTok