Low Rates.

Our rates are low, our application is quick and easy! We can get you clear to close in as little as 10 days!

Trusted By Agents With

Meet Bill Rapp

NMLS ID # NMLS # 228246

William Rapp, based in Houston, TX, US, is currently a Capital Advisor at Medallion Funds, bringing experience from previous roles at eXp Commercial, NEXA Mortgage, Viking Enterprise LLC and Sun Realty - Houston. William Rapp holds a 1997 - 2001 BBA in Finance @ Texas A&M University. With a robust skill set that includes REO, Sellers, SFR, FHA financing, Reverse Mortgages and more, William Rapp contributes valuable insights to the industry.

The Client Experience

Great experience purchasing our first home! Bill was easy to reach and always able to answer any questions or concerns.

Blogs

The Top 5 Mortgage Mistakes to Avoid

Buying your first home can be both exciting and nerve-wracking at the same time. With so many things to consider and....

Mortgage Do and

Do not list

Mortgages can be tricky, and it's easy to make mistakes that can end up costing you dearly. That's why we've put together this list....

Tips On How To Improve Your Credit Score

Let's talk about some ways you can improve your credit score! Your credit score is actually a big deal, and it can affect...

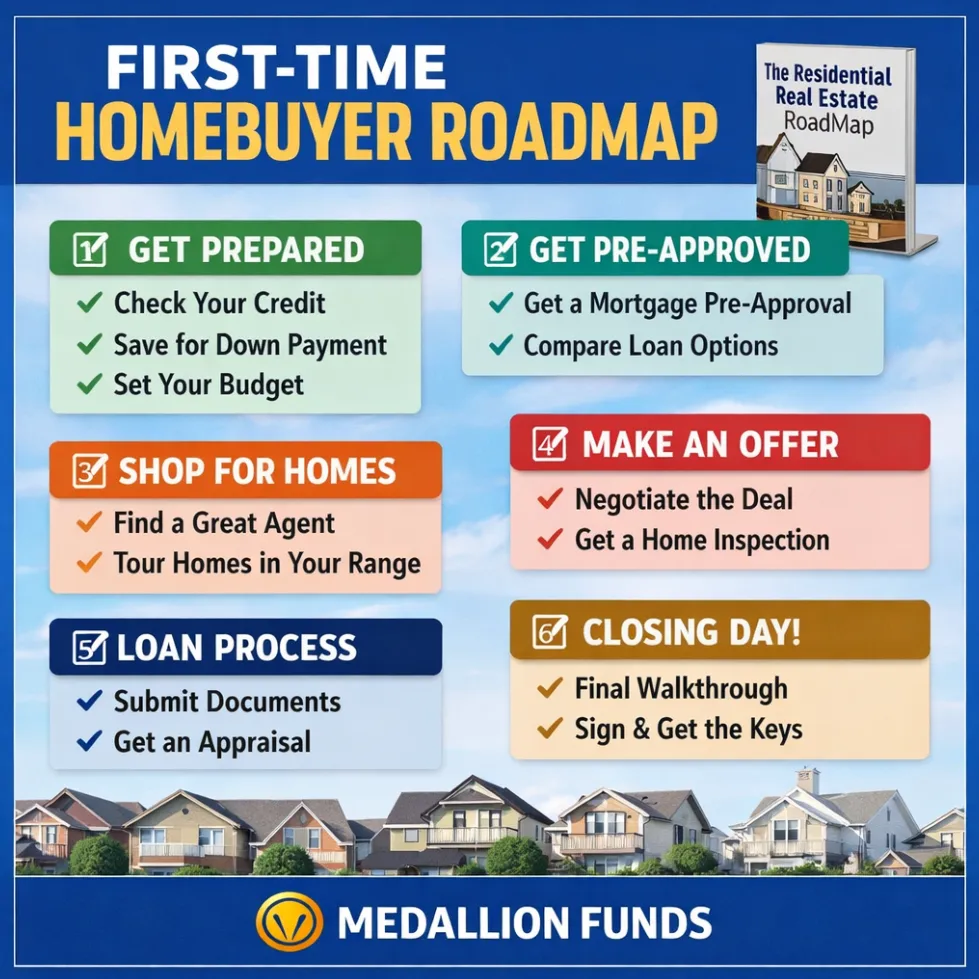

🏡 First-Time Homebuyer Guide with Checklists: From Pre-Approval to Closing ✅

🏡 First-Time Homebuyer Guide with Checklists: From Pre-Approval to Closing ✅

📋 First-Time Buyer Mortgage Checklist: Step-by-Step to Homeownership 🔑

First-Time Buyer Guides With Checklists: From Pre-Approval to Closing

Buying your first home can feel overwhelming—not because it’s impossible, but because most buyers don’t have a clear roadmap. Timelines blur together, paperwork piles up, and critical steps get missed.

This first-time homebuyer guide with checklists is designed to turn intent into action. Whether you’re just starting to think about buying or already browsing homes online, this step-by-step framework walks you through the process from pre-approval to closing, exactly how lenders and real estate professionals see it.

Step 1: Financial Readiness Checklist (Before You Apply)

Before talking to a lender, get organized. This saves time, reduces stress, and improves loan options.

Checklist:

Review credit reports (all three bureaus)

Avoid new debt or large purchases

Save for down payment + closing costs

Confirm stable income and employment

Set a realistic monthly payment target

Pro Tip: Many first-time buyers qualify sooner than they think—but small credit or documentation issues can delay approval if not addressed early.

Step 2: Mortgage Pre-Approval Checklist

A pre-approval is not optional—it’s your entry ticket to serious home shopping.

Checklist:

Complete loan application

Provide income, asset, and ID documentation

Review loan programs (FHA, Conventional, VA, Doctor Loans)

Lock in a realistic price range

Get a fully underwritten pre-approval when possible

This is where working with a mortgage broker makes a difference. Instead of one bank’s rules, you gain access to multiple lenders and programs.

Step 3: Home Shopping Checklist

Now the fun part—but structure matters.

Checklist:

Hire a buyer’s agent experienced with first-time buyers

Compare neighborhoods, taxes, and insurance costs

Tour homes within—not above—your approved range

Understand HOA rules and future resale factors

Prepare for competitive offer scenarios

Step 4: Offer & Contract Checklist

Once you find “the one,” precision matters.

Checklist:

Review purchase contract carefully

Confirm earnest money and option period

Coordinate lender, agent, and title company

Order home inspection immediately

Avoid job changes or credit activity

Step 5: Loan Processing & Underwriting Checklist

This phase is paperwork-heavy but manageable with guidance.

Checklist:

Submit updated pay stubs and bank statements

Respond quickly to lender conditions

Lock your interest rate strategically

Review Loan Estimate for accuracy

Schedule appraisal

Step 6: Closing Checklist (Final Week)

You’re almost there.

Checklist:

Review Closing Disclosure

Confirm funds needed to close

Schedule final walkthrough

Bring valid ID to closing

Get keys and celebrate 🎉

Want the Entire Process in One Place?

This blog gives you the overview. My book, The Residential Real Estate Roadmap, gives you the full system—checklists, explanations, lender insights, and real-world examples—written specifically for first-time buyers who want clarity, not confusion.

📘 Buy on Amazon:

https://www.amazon.com/dp/B0D4JZQK9P

🌐 Author Website & Resources:

https://author.billrapponline.com

Bottom Line

First-time buyers don’t fail because of bad luck—they fail because they don’t have a plan. With the right checklist and the right lender, buying your first home becomes a structured, confident process.

https://www.billrapponline.com/

https://findamortgagebroker.com/Profile/WilliamRappJr28883

https://billrapp.commloan.com/

https://billrapponline.com/financingfuturescre-houston-katy

https://houstoncommercialmortgage.com/

https://author.billrapponline.com

https://doctorvideo.billrapponline.com/

https://veteransvideo.billrapponline.com/

https://mortgageviking.billrapponline.com/

https://fha203h.billrapponline.com/

https://renovationvideo.billrapponline.com

https://medallionfunds.com/bill-rapp/

https://www.amazon.com/dp/B0F32Z5BH2

https://veed.cello.so/FOmzTty6oi9

https://creplaybookseries.billrapponline.com

https://creplaybook.billrapponline.com/

© 2023-2024 Bill Rapp, Medallion Funds LLC, Director of Capital Advisory

10 Tips for First-Time Homebuyers

Buying your first home can be both exciting and nerve-wracking at the same time. With so many things to consider and....

How To Choose the Right Lender for You

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy

Refinancing youe loan and when to do it

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy

Copyright ©2021 | Mortgage Viking Team

Licensed to Do Business | NMLS # 228246

This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Copyright © 2021 | Medallion Funds

Corporate | NMLS ID NMLS # 1825831

Corporate Address : 2651 N. Green Valley Pkwy STE. 101 Henderson, NV 89014

Corporate NMLS NMLS # 1825831 | Company Website: https://medallionfunds.com/bill-rapp/

Copyright ©2021 | Mortgage Viking Team Licensed to Do Business | NMLS # 228246

This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply

Corporate | NMLS ID NMLS # 1825831

Corporate Address : 2651 N. Green Valley Pkwy STE. 101 Henderson, NV 89014 https://medallionfunds.com/bill-rapp/

Facebook

Instagram

X

LinkedIn

Youtube

TikTok