🔄 Commercial Mortgage Refinancing Explained: Lower Payments, Better Terms & More Cash Flow 💰

🔄 Commercial Mortgage Refinancing Explained: Lower Payments, Better Terms & More Cash Flow 💰

🏢 Commercial Mortgage Refinancing 101: When to Refinance, Why It Matters & How to Win 🔄

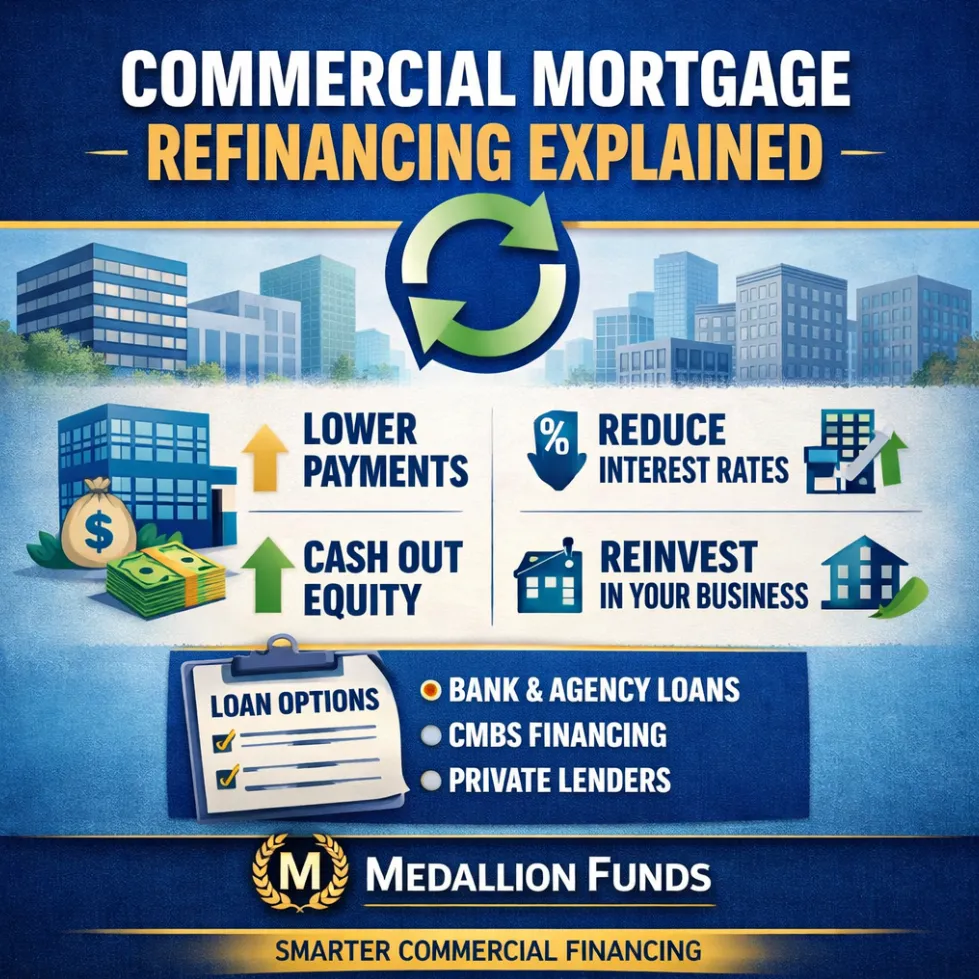

Commercial Mortgage Refinancing Explained 🔄

Commercial mortgage refinancing is one of the most powerful—and misunderstood—tools available to real estate investors and business owners. When executed correctly, refinancing can improve cash flow, unlock equity, reduce risk, and reposition a property for long-term success. When done poorly, it can destroy value.

At Medallion Funds, we help clients refinance commercial properties with a strategy-first approach—not just a rate quote.

What Is Commercial Mortgage Refinancing?

Commercial mortgage refinancing replaces an existing commercial loan with a new one—often with different terms, structure, or lender type. Unlike residential loans, commercial refinancing is driven by cash flow, asset performance, and market positioning, not personal income alone.

Common refinance objectives include:

Lowering debt service

Pulling cash out for reinvestment

Replacing short-term or floating-rate debt

Resetting loan maturity

Removing partners or restructuring ownership

Key Reasons Investors Refinance Commercial Property

1. Improve Cash Flow

Refinancing into a longer amortization or lower spread can significantly reduce monthly payments—especially important in today’s tighter operating margins.

2. Cash-Out Refinance for Growth

Many investors refinance to pull equity and fund:

New acquisitions

Capital improvements

Partner buyouts

Debt consolidation

3. Reduce Interest Rate or Risk

Moving from:

Floating → fixed rates

Bridge → permanent debt

Private → bank or agency financing

can materially reduce exposure to market volatility.

4. Reposition the Asset

A stabilized or renovated property may now qualify for better loan terms than when it was originally financed.

Commercial Refinance Loan Options Explained

Refinancing is not one-size-fits-all. Options include:

Bank & Credit Union Loans

Lower rates

Conservative underwriting

Strong DSCR and balance sheet required

Agency Loans (Fannie / Freddie)

Ideal for stabilized multifamily

Long-term fixed rates

Non-recourse options

CMBS Loans

Higher leverage

Yield maintenance or defeasance

Useful for larger assets

Debt Funds & Private Capital

Flexible underwriting

Faster execution

Higher rates but fewer constraints

The “best” refinance depends on strategy, not headlines.

What Lenders Evaluate in a Commercial Refinance

Lenders focus on:

Debt Service Coverage Ratio (DSCR)

Net operating income (NOI)

Loan-to-value (LTV)

Property condition and market

Sponsorship experience

Exit strategy

This is why refinancing should be planned months in advance, not weeks.

Common Commercial Refinancing Mistakes

Waiting until loan maturity

Chasing rate instead of structure

Ignoring prepayment penalties

Overestimating appraised value

Underestimating lender reserves and escrows

These mistakes cost investors time, leverage, and credibility.

How Medallion Funds Structures Smarter Refinances

We approach refinancing as a capital advisory process, not a transaction:

Analyze current and future cash flow

Stress-test DSCR and rate scenarios

Match the loan to your hold strategy

Coordinate timing with market conditions

The goal is not just approval—it’s long-term control and flexibility.

Final Thoughts

Commercial mortgage refinancing is a strategic reset. Done correctly, it strengthens your balance sheet and positions your portfolio for the next cycle.

If you are approaching maturity, facing higher payments, or sitting on untapped equity, now is the time to review your options.

https://www.billrapponline.com/

https://findamortgagebroker.com/Profile/WilliamRappJr28883

https://billrapp.commloan.com/

https://billrapponline.com/financingfuturescre-houston-katy

https://houstoncommercialmortgage.com/

https://author.billrapponline.com

https://doctorvideo.billrapponline.com/

https://veteransvideo.billrapponline.com/

https://mortgageviking.billrapponline.com/

https://fha203h.billrapponline.com/

https://renovationvideo.billrapponline.com

https://medallionfunds.com/bill-rapp/

https://www.amazon.com/dp/B0F32Z5BH2

https://veed.cello.so/FOmzTty6oi9

https://creplaybookseries.billrapponline.com

https://creplaybook.billrapponline.com/

© 2023-2024 Bill Rapp, Medallion Funds LLC, Director of Capital Advisory