💼 Debt Funds Are Redefining CRE Distress in 2026 📉➡️📈

💼 Debt Funds Are Redefining CRE Distress in 2026 📉➡️📈

🏗️ Why CRE Distress Isn’t Triggering Fire Sales Anymore 💰

Debt Funds and the New Shape of CRE Distress

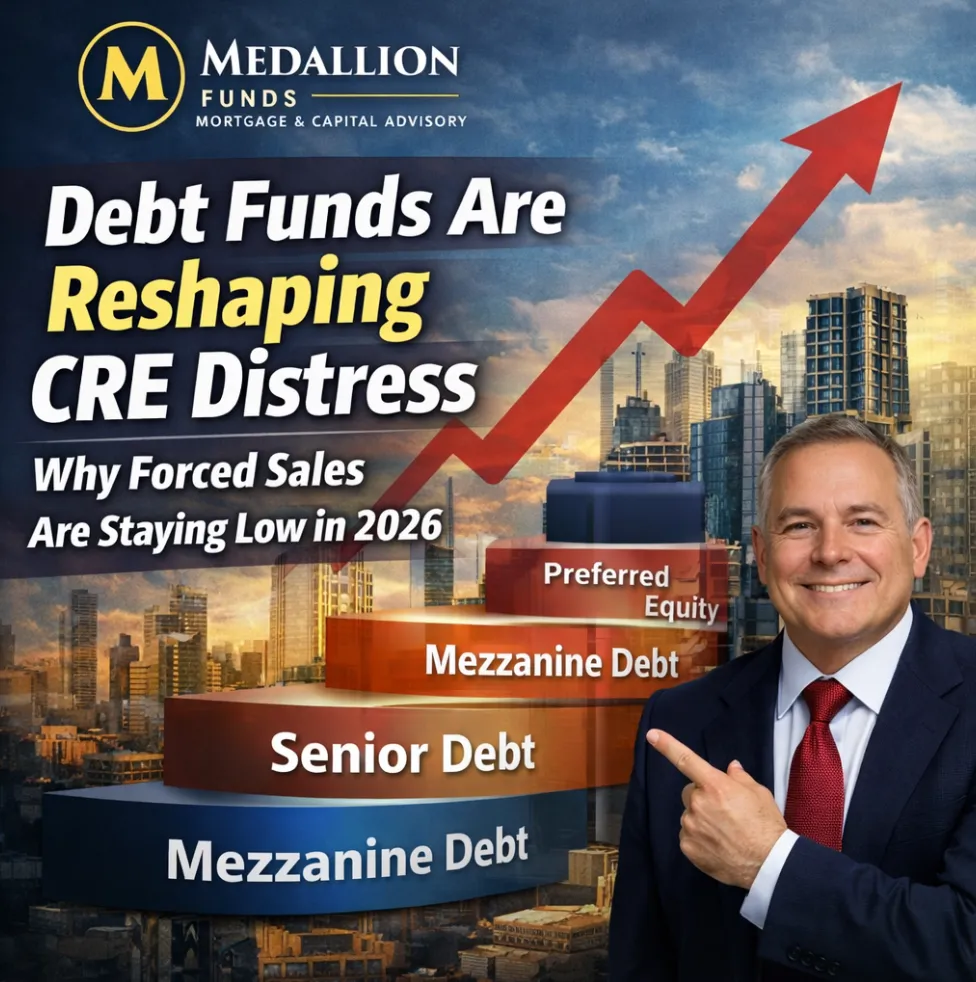

Commercial real estate distress in the current cycle looks nothing like the aftermath of the Global Financial Crisis. While headlines continue to focus on rising defaults and valuation resets, the data tells a very different story: forced asset sales remain historically low. The primary reason is structural—private debt funds, especially those active in mezzanine lending, have fundamentally reshaped how distress is absorbed and resolved in a positive way.

Distressed Sales Are Historically Muted

Following the Global Financial Crisis, distressed assets represented nearly 20 percent of all commercial property sales by 2010. By comparison, distressed transactions accounted for only about 3 percent of total sales by mid-2025. Even with rising maturity defaults, property values have declined roughly 10 percent this cycle—far less severe than the 23 percent year-over-year correction seen in 2009. Without deep equity impairment, widespread liquidation pressure has simply not materialized.

Private Debt Funds Have Rewritten the Capital Stack

Post-GFC regulatory changes, including HVCRE requirements, significantly reduced banks’ willingness to hold higher-risk construction, bridge, and transitional loans. That void has been filled aggressively by private debt funds. Institutional capital has flowed into these vehicles at scale, giving them flexibility to price risk, structure creatively, and operate across senior, mezzanine, and preferred equity positions.

Market data tracked by MSCI shows a strong correlation between rising dry powder and increased lending activity from these investor-driven lenders. Rather than pulling back during volatility, debt funds have leaned in—providing rescue capital and extension financing that prevents assets from being pushed into forced sales.

Distress Is Concentrated Higher in the Capital Stack

The stress in this cycle is not primarily at the asset level—it is higher in the capital stack. Senior debt performance has remained relatively stable, with income accounting for more than 100 percent of total returns between 2020 and 2025. Mezzanine debt, by contrast, has absorbed significantly more pressure. Losses have pushed income returns above 200 percent, signaling that subordinated capital—not property fundamentals—is where distress is being realized.

Mezzanine Capital Is Reshaping Workouts

Rather than defaulting directly into foreclosure, many sponsors are turning to mezzanine lenders to inject capital and extend runway. These lenders often gain control rights upon default, allowing them to influence recapitalizations, restructures, or sponsor transitions more efficiently. The result is faster resolution, fewer legal delays, and a controlled workout process that preserves asset value.

What This Means for Investors and Borrowers

The modern CRE distress cycle is being resolved through capital restructuring, not mass liquidation. For investors seeking exposure to distress, mezzanine positions often provide faster access to value with greater control and fewer headline risks than traditional foreclosure strategies. For borrowers, understanding the evolving role of debt funds is critical when navigating refinances, extensions, or recapitalizations.

Bottom line: CRE distress hasn’t disappeared—it has moved up the stack. And debt funds are now the primary shock absorbers.

https://www.billrapponline.com/

https://findamortgagebroker.com/Profile/WilliamRappJr28883

https://billrapp.commloan.com/

https://billrapponline.com/financingfuturescre-houston-katy

https://houstoncommercialmortgage.com/

https://author.billrapponline.com

https://doctorvideo.billrapponline.com/

https://veteransvideo.billrapponline.com/

https://mortgageviking.billrapponline.com/

https://fha203h.billrapponline.com/

https://renovationvideo.billrapponline.com

https://medallionfunds.com/bill-rapp/

https://www.amazon.com/dp/B0F32Z5BH2

https://veed.cello.so/FOmzTty6oi9

https://creplaybookseries.billrapponline.com

https://creplaybook.billrapponline.com/

© 2023-2024 Bill Rapp, Medallion Funds LLC, Director of Capital Advisory