🏡 First-Time Homebuyer Guide with Checklists: From Pre-Approval to Closing ✅

🏡 First-Time Homebuyer Guide with Checklists: From Pre-Approval to Closing ✅

📋 First-Time Buyer Mortgage Checklist: Step-by-Step to Homeownership 🔑

First-Time Buyer Guides With Checklists: From Pre-Approval to Closing

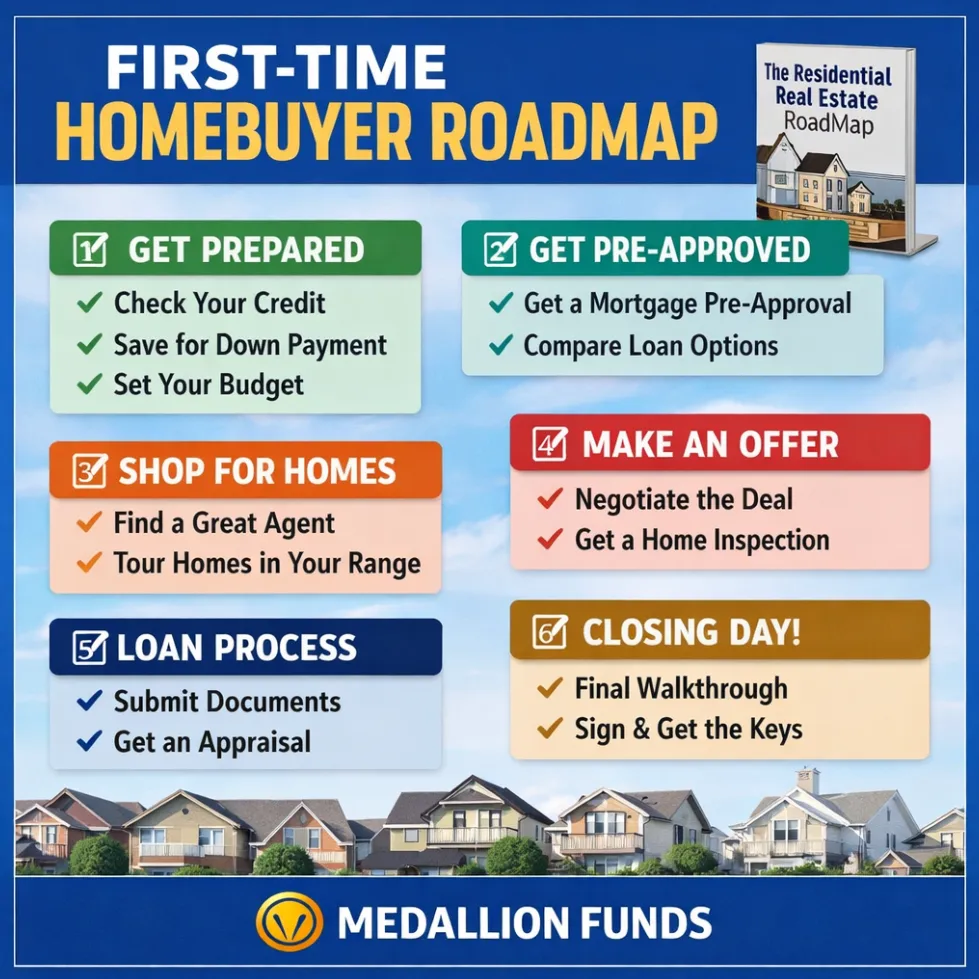

Buying your first home can feel overwhelming—not because it’s impossible, but because most buyers don’t have a clear roadmap. Timelines blur together, paperwork piles up, and critical steps get missed.

This first-time homebuyer guide with checklists is designed to turn intent into action. Whether you’re just starting to think about buying or already browsing homes online, this step-by-step framework walks you through the process from pre-approval to closing, exactly how lenders and real estate professionals see it.

Step 1: Financial Readiness Checklist (Before You Apply)

Before talking to a lender, get organized. This saves time, reduces stress, and improves loan options.

Checklist:

Review credit reports (all three bureaus)

Avoid new debt or large purchases

Save for down payment + closing costs

Confirm stable income and employment

Set a realistic monthly payment target

Pro Tip: Many first-time buyers qualify sooner than they think—but small credit or documentation issues can delay approval if not addressed early.

Step 2: Mortgage Pre-Approval Checklist

A pre-approval is not optional—it’s your entry ticket to serious home shopping.

Checklist:

Complete loan application

Provide income, asset, and ID documentation

Review loan programs (FHA, Conventional, VA, Doctor Loans)

Lock in a realistic price range

Get a fully underwritten pre-approval when possible

This is where working with a mortgage broker makes a difference. Instead of one bank’s rules, you gain access to multiple lenders and programs.

Step 3: Home Shopping Checklist

Now the fun part—but structure matters.

Checklist:

Hire a buyer’s agent experienced with first-time buyers

Compare neighborhoods, taxes, and insurance costs

Tour homes within—not above—your approved range

Understand HOA rules and future resale factors

Prepare for competitive offer scenarios

Step 4: Offer & Contract Checklist

Once you find “the one,” precision matters.

Checklist:

Review purchase contract carefully

Confirm earnest money and option period

Coordinate lender, agent, and title company

Order home inspection immediately

Avoid job changes or credit activity

Step 5: Loan Processing & Underwriting Checklist

This phase is paperwork-heavy but manageable with guidance.

Checklist:

Submit updated pay stubs and bank statements

Respond quickly to lender conditions

Lock your interest rate strategically

Review Loan Estimate for accuracy

Schedule appraisal

Step 6: Closing Checklist (Final Week)

You’re almost there.

Checklist:

Review Closing Disclosure

Confirm funds needed to close

Schedule final walkthrough

Bring valid ID to closing

Get keys and celebrate 🎉

Want the Entire Process in One Place?

This blog gives you the overview. My book, The Residential Real Estate Roadmap, gives you the full system—checklists, explanations, lender insights, and real-world examples—written specifically for first-time buyers who want clarity, not confusion.

📘 Buy on Amazon:

https://www.amazon.com/dp/B0D4JZQK9P

🌐 Author Website & Resources:

https://author.billrapponline.com

Bottom Line

First-time buyers don’t fail because of bad luck—they fail because they don’t have a plan. With the right checklist and the right lender, buying your first home becomes a structured, confident process.

https://www.billrapponline.com/

https://findamortgagebroker.com/Profile/WilliamRappJr28883

https://billrapp.commloan.com/

https://billrapponline.com/financingfuturescre-houston-katy

https://houstoncommercialmortgage.com/

https://author.billrapponline.com

https://doctorvideo.billrapponline.com/

https://veteransvideo.billrapponline.com/

https://mortgageviking.billrapponline.com/

https://fha203h.billrapponline.com/

https://renovationvideo.billrapponline.com

https://medallionfunds.com/bill-rapp/

https://www.amazon.com/dp/B0F32Z5BH2

https://veed.cello.so/FOmzTty6oi9

https://creplaybookseries.billrapponline.com

https://creplaybook.billrapponline.com/

© 2023-2024 Bill Rapp, Medallion Funds LLC, Director of Capital Advisory