🏦 How Lenders Evaluate CRE Deals | Key Metrics Every Investor Must Know 📊

🏦 How Lenders Evaluate CRE Deals | Key Metrics Every Investor Must Know 📊

💼 Commercial Real Estate Loan Underwriting Explained | What Banks & Lenders Look For 🏢

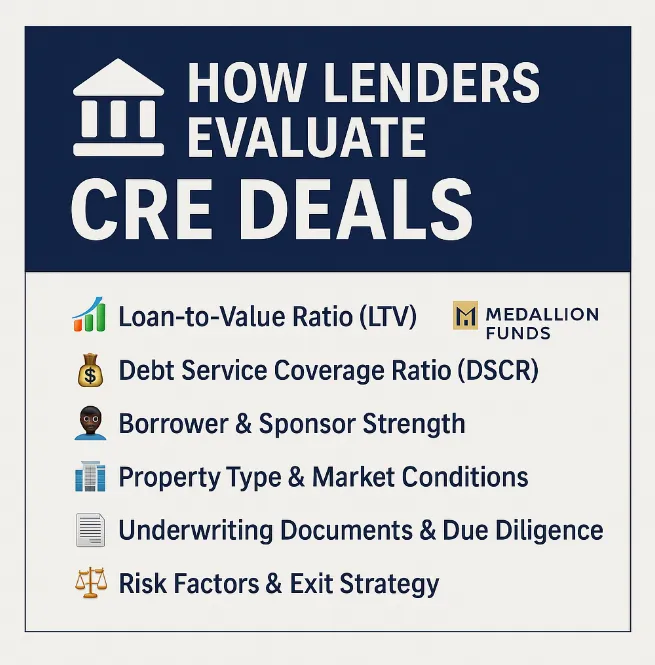

🏦 How Lenders Evaluate CRE Deals: What Investors Need to Know

When it comes to commercial real estate (CRE) financing, securing the right loan often comes down to how well your deal holds up under a lender’s microscope. Lenders don’t just look at the property itself—they analyze a combination of financial metrics, market conditions, sponsor strength, and risk factors to decide whether to approve your loan.

As a mortgage brokerage, Medallion Funds works with investors, developers, and business owners every day to package their deals in a way that lenders want to see. Let’s break down the key elements lenders evaluate in CRE deals so you can position yourself for success.

📊 1. Loan-to-Value Ratio (LTV)

One of the first things a lender reviews is the Loan-to-Value (LTV) ratio, which measures the loan amount compared to the property’s value.

·Typical LTVs:

oMultifamily/Industrial: 70–80%

oRetail/Office: 65–75%

·Lower LTV = lower risk for the lender.

Tip: A strong appraisal and showing equity skin in the game increase your approval chances.

💰 2. Debt Service Coverage Ratio (DSCR)

The DSCR shows how well the property’s income can cover the loan payments. Most lenders require:

·1.20–1.25 DSCR for stabilized assets

·Higher DSCR for riskier deals like retail or new construction

Formula: Net Operating Income (NOI) ÷ Debt Service = DSCR

Tip: If your DSCR is tight, consider improving NOI by cutting expenses or raising rents before applying.

👤 3. Borrower & Sponsor Strength

Lenders want to know who’s behind the deal:

·Net worth and liquidity relative to loan size

·Real estate experience and track record

·Business plan execution ability

Tip: Partnering with a strong co-sponsor can help if you’re light on experience.

🏢 4. Property Type & Market Conditions

Lenders evaluate both the asset class and the location market:

·Industrial and multifamily: typically favored

·Office and retail: scrutinized more heavily

·Submarket vacancy rates, absorption trends, and local economic drivers

Tip: Be ready to explain why your property and market are positioned for success despite broader trends.

📑 5. Underwriting Documents & Due Diligence

Expect requests for:

·Rent rolls & operating statements

·Leases & tenant financials (for retail/office)

·Appraisal, Phase I ESA, and PCA (Property Condition Assessment)

Tip: Organize your documents early. A clean, complete package signals professionalism and reduces lender hesitation.

⚖️ 6. Risk Factors & Exit Strategy

Finally, lenders consider what could go wrong and how you’ll protect against it.

·Lease rollover risk

·Construction cost overruns

·Market downturns

They’ll also ask: What’s your exit plan? (refinance, sale, or long-term hold).

✅ Takeaway

Understanding how lenders evaluate CRE deals allows you to structure stronger loan requests and move through underwriting faster. At Medallion Funds, we help investors and business owners present deals in the best possible light—maximizing approvals and negotiating the most competitive terms.

📞 Ready to finance your next project? Contact Medallion Funds today for tailored CRE financing solutions.

https://www.billrapponline.com/

https://findamortgagebroker.com/Profile/WilliamRappJr28883

https://billrapp.commloan.com/

https://billrapponline.com/financingfuturescre-houston-katy

https://houstoncommercialmortgage.com/

https://author.billrapponline.com

https://doctorvideo.billrapponline.com/

https://veteransvideo.billrapponline.com/

https://mortgageviking.billrapponline.com/

https://fha203h.billrapponline.com/

https://renovationvideo.billrapponline.com

https://medallionfunds.com/bill-rapp/

https://www.amazon.com/dp/B0F32Z5BH2

https://veed.cello.so/FOmzTty6oi9

© 2023-2024 Bill Rapp, Medallion Funds LLC, Director of Capital Advisory