💼 Medallion Funds vs Boutique Brokerages: Pros & Cons for Loan Officers 🔑

💼 Medallion Funds vs Boutique Brokerages: Pros & Cons for Loan Officers 🔑

📊 Why Join Medallion Funds? Comparing to Boutique Mortgage Brokerages 🏦

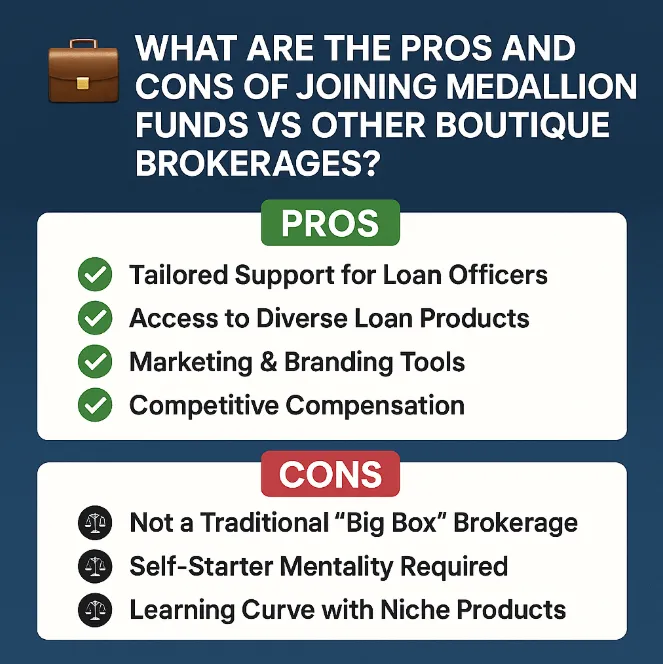

What are the Pros and Cons of Joining Medallion Funds vs Other Boutique Brokerages?

Choosing the right brokerage is one of the most important decisions for any loan officer or mortgage professional. With so many boutique brokerages promising competitive splits, marketing support, and growth opportunities, it can be hard to know which path is best. Let’s break down how Medallion Funds stacks up compared to other boutique mortgage brokerages—so you can make an informed decision.

✅ Pros of Joining Medallion Funds

1. Tailored Support for Loan Officers

Medallion Funds offers individualized coaching and mentorship from experienced industry professionals. Unlike many boutique firms, our focus isn’t just production—it’s about helping you build a long-term, sustainable book of business.

2. Access to Diverse Loan Products

From DSCR loans for investors to doctor mortgage programs and FHA/VA options, Medallion Funds provides more than just conventional lending. This wide range of products helps you serve more clients and close more deals.

3. Marketing & Branding Tools

We equip our loan officers with done-for-you marketing content, YouTube strategies, and social media campaigns—saving you time while boosting your personal brand.

4. Competitive Compensation

Medallion Funds offers splits that compete with or beat many boutique brokerages, while also giving you access to shared resources and lead opportunities.

⚖️ Cons of Joining Medallion Funds

1. Not a Traditional “Big Box” Brokerage

If you’re looking for a massive brand name like Wells Fargo or Rocket Mortgage, Medallion Funds isn’t that. We’re boutique in nature, which means we thrive on personalized service—not sheer scale.

2. Self-Starter Mentality Required

While we provide support and systems, success at Medallion Funds comes down to your drive and consistency. If you need constant hand-holding, this might not be the right fit.

3. Learning Curve with Niche Products

Offering DSCR, non-QM, and construction loans is a huge advantage—but it requires a willingness to learn and adapt compared to standard cookie-cutter mortgages.

📌 Bottom Line

For loan officers looking to grow their business with flexible products, strong mentorship, and competitive pay structures, Medallion Funds offers a unique edge over other boutique brokerages. However, it requires initiative and a growth mindset to maximize the opportunity.

https://www.billrapponline.com/

https://findamortgagebroker.com/Profile/WilliamRappJr28883

https://billrapp.commloan.com/

https://billrapponline.com/financingfuturescre-houston-katy

https://houstoncommercialmortgage.com/

https://author.billrapponline.com

https://doctorvideo.billrapponline.com/

https://veteransvideo.billrapponline.com/

https://mortgageviking.billrapponline.com/

https://fha203h.billrapponline.com/

https://renovationvideo.billrapponline.com

https://medallionfunds.com/bill-rapp/

https://www.amazon.com/dp/B0F32Z5BH2

https://veed.cello.so/FOmzTty6oi9

© 2023-2024 Bill Rapp, Medallion Funds LLC, Director of Capital Advisory