Midtown Redevelopment Authority Corruption: $8.5M Misused

Midtown Redevelopment Authority Corruption: $8.5M Misused

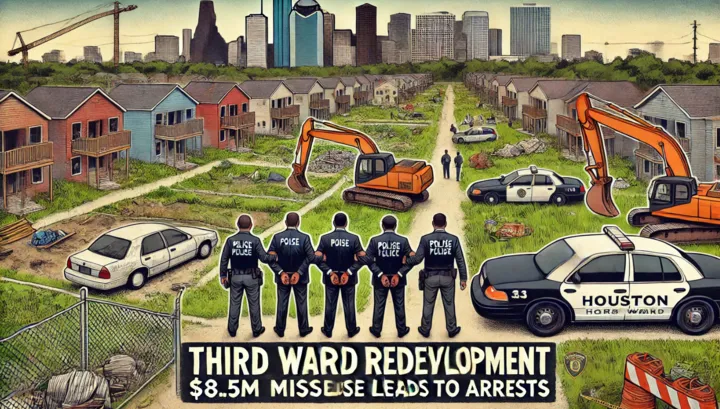

On October 31, 2023, construction was underway on a previously-owned Midtown Redevelopment Authority (MRA) lot in Houston’s Third Ward. This area has been at the center of controversy following the recent arrests of a former MRA staffer and two contractors on charges of public corruption.

The Harris County District Attorney’s Office announced the arrests of Todd Edwards, a former real estate manager at MRA, and contractors Veronica Ugorgi and Kenneth Jones. The trio faces charges related to the misuse of approximately $8.5 million in public funds. Edwards, accused of exploiting his oversight of MRA landscaping funds for personal gain, allegedly collaborated with Ugorgi and Jones in this scheme.

District Attorney Kim Ogg addressed the media, emphasizing the gravity of the charges. “Mr. Edwards and his co-defendants’ scheme to steal and misuse this money has resulted in first-degree felony charges against each of them,” she stated. “These charges carry potential life sentences. Unfortunately, our tax dollars meant to improve the lives of Houstonians were spent on flashy cars, nice houses, super living, trips, and pornography.”

For years, Third Ward residents voiced concerns about the MRA’s failure to deliver on promises of affordable housing. Empty lots, overtaken by vegetation despite substantial landscaping contracts, became symbols of mismanagement. Accusations against Edwards culminated in an investigation by Houston’s Office of Inspector General. The investigation confirmed that Edwards had misused his position to benefit himself and Cortez Landscaping, a contractor.

Edwards was dismissed from his position on May 31, 2023, due to allegations of an inappropriate relationship with a contractor. Following his termination, the Harris County District Attorney’s Office launched a formal investigation in November 2023.

The MRA, in response to the charges, declared that the alleged actions are “entirely contrary to the values and principles under which the MRA operates.” They assured the public that comprehensive measures have been implemented to enhance financial and procurement controls.

Houston Mayor John Whitmire expressed zero tolerance for such criminal activities. “My office, the inspector general’s office, all our department heads have been put on notice that we won’t tolerate it,” he stated. He also mentioned plans to review all Tax Increment Reinvestment Zones (TIRZs) across Houston.

Community members Ed Pettitt and Brian Van Tubergen played crucial roles in bringing these issues to light. Their persistent efforts, including a formal complaint filed with the Office of Inspector General in 2022, were instrumental in uncovering the corruption.

“It felt like we were arguing at a brick wall this entire previous administration because no one was willing to hold the Midtown Redevelopment Authority accountable,” Pettitt remarked. He expressed gratitude to Mayor Whitmire and Kim Ogg for pursuing the investigation and securing indictments.

At the press conference, Ogg praised Pettitt and Van Tubergen for their relentless pursuit of justice, referring to them as a “Batman and Robin team.” Pettitt concluded, “I think the Midtown issue is just the tip of the iceberg.”

Should you need an experienced Commercial Real Estate Broker & Mortgage Broker, please feel free to contact me at 281-222-0433.

https://www.houstonrealestatebrokerage.com/

https://www.commercialexchange.com/agent/653bf5593e3a3e1dcec275a6

http://expressoffers.com/[email protected]

https://www.tenantbase.com/advisors/bill-rapp/

https://buildout.com/plugins/3e7ef61d54725c99fd76ca1f4ae24a348c56a0d4/brokers/[email protected]

www.linkedin.com/comm/mynetwork/discovery-see-all?usecase=PEOPLE_FOLLOWS&followMember=mortgageviking

https://www.fastexpert.com/agents/bill-rapp-95118/

https://www.homelight.com/agents/bill-rapp-tx-595622?preview=t

https://www.houstonrealestatebrokerage.com/houston-cre-navigator

© 2023-2024 Bill Rapp, Broker Associate, eXp Commercial LLC

https://medallionfunds.com/bill-rapp/

https://www.billrapponline.com/

https://houstoncommercialmortgage.com/

https://findamortgagebroker.com/Profile/WilliamRappJr28883

https://doctorvideo.billrapponline.com/

https://veteransvideo.billrapponline.com/

https://mortgageviking.billrapponline.com/

https://fha203h.billrapponline.com/

https://renovationvideo.billrapponline.com/

https://www.smartbizloans.com/partner/vikingenterprisellc/bill

https://www.fastexpert.com/loan-officer/bill-rapp-95119/

https://billrapponline.com/financingfuturescre-houston-katy

© 2023-2024 Bill Rapp, Medallion Funds LLC, Director of Capital Advisory