🏠 Where Homes Are (and Aren’t) Affordable in 2025 📉📈

🏠 Where Homes Are (and Aren’t) Affordable in 2025 📉📈

📊 Housing Affordability Crisis: Where Buyers Still Have a Chance 🏡

Where Americans Can’t Afford Homes—And Where Buyers Still Can

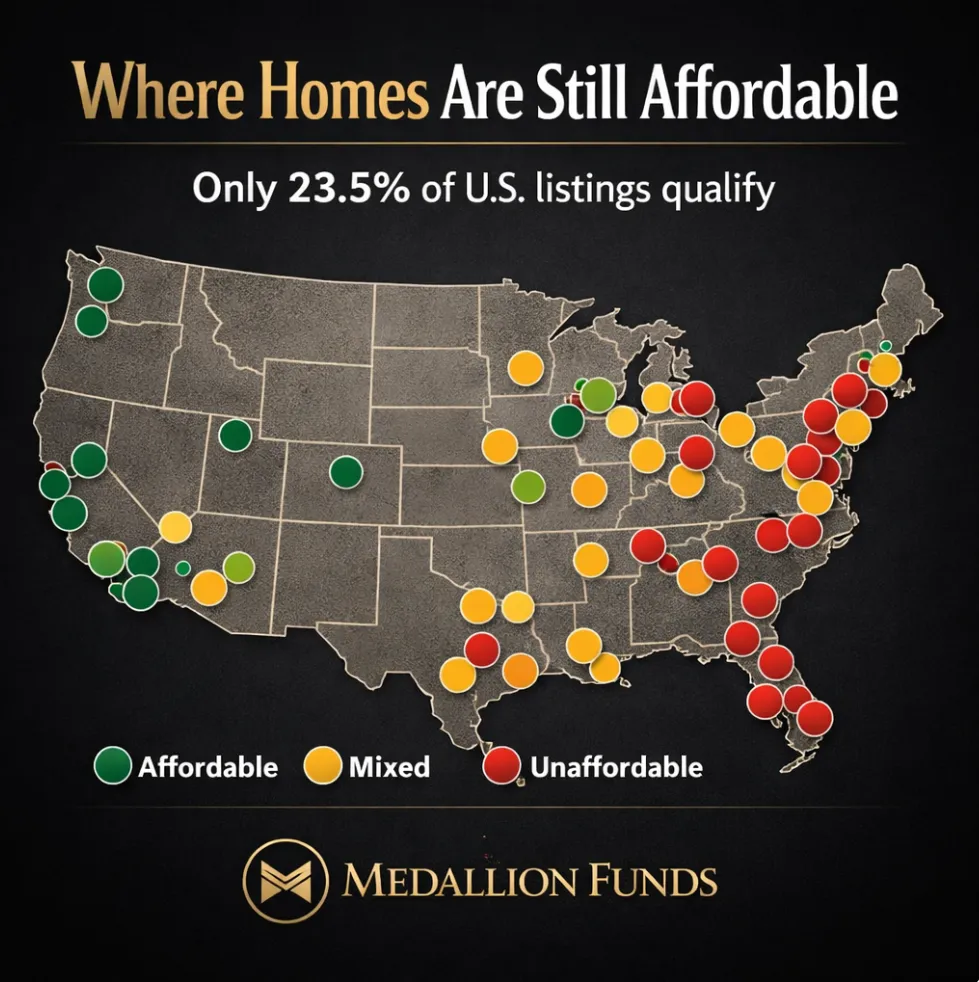

Most Americans cannot afford the homes currently for sale—and where you live matters more than ever.

U.S. housing affordability remains severely constrained. As of July 2025, more than 75% of homes on the market are unaffordable to households earning the national median income of roughly $80,000. Across the 34 largest metro areas, only 23.5% of listings meet standard affordability thresholds.

This isn’t just about mortgage rates. It is the combined effect of elevated home prices, limited housing supply, and uneven construction activity across regions.

📍 Where Homes Are Most Affordable

Affordability improves meaningfully in parts of the Midwest, Rust Belt, and select Southern markets where prices have grown more slowly and supply constraints are less severe.

Markets offering the strongest opportunities for middle-income buyers include:

·Pittsburgh – Approximately 55% of listings affordable

·St. Louis – Roughly 50% affordable

·Baltimore, Detroit, Cincinnati, Birmingham – Around 40% affordable

For buyers willing to be flexible on location—or open to relocating—these markets present realistic ownership paths with standard mortgage structures.

🚫 Where Homes Are Least Affordable

Coastal metros and high-growth Sun Belt cities remain largely inaccessible for median-income households.

Examples include:

·Miami – Just 0.4% of listings affordable

·Los Angeles – Fewer than 2% affordable

·San Diego – Also below 2%

In these markets, price growth has far outpaced income growth, and supply shortages continue to push affordability further out of reach—even for high-earning households.

🧮 Why the Math Doesn’t Work for Most Buyers

This analysis assumes:

·20% down payment

·6.8% 30-year fixed mortgage rate

·Housing costs capped at 30% of gross income

Under those assumptions, the median U.S. home price of $435,000 requires household income of roughly $113,000 per year—about $33,000 above the national median.

This gap explains why many qualified buyers feel “priced out” despite stable employment and strong credit.

🏗️ Supply Is the Real Constraint

Housing supply is diverging sharply by region:

·The South and parts of the West have added inventory through new construction, improving long-term affordability outlooks.

·The Northeast and Midwest remain 40%–60% below pre-pandemic inventory levels, keeping pressure on prices despite slower population growth.

Builders are adapting. Townhomes now account for 18% of single-family construction, nearly double their share a decade ago, making them one of the most important affordability levers for first-time buyers.

🧭 What This Means for Buyers

Even if mortgage rates decline, affordability will not meaningfully improve without sustained increases in housing supply—especially in job-rich, high-demand metros.

This is where mortgage strategy matters. Buyers who understand:

·Market-specific affordability

·Alternative loan structures

·First-time buyer and professional programs

will continue to win—even in constrained markets.

https://www.billrapponline.com/

https://findamortgagebroker.com/Profile/WilliamRappJr28883

https://billrapp.commloan.com/

https://billrapponline.com/financingfuturescre-houston-katy

https://houstoncommercialmortgage.com/

https://author.billrapponline.com

https://doctorvideo.billrapponline.com/

https://veteransvideo.billrapponline.com/

https://mortgageviking.billrapponline.com/

https://fha203h.billrapponline.com/

https://renovationvideo.billrapponline.com

https://medallionfunds.com/bill-rapp/

https://www.amazon.com/dp/B0F32Z5BH2

https://veed.cello.so/FOmzTty6oi9

https://buymeacoffee.com/vikingente3

https://creplaybookseries.billrapponline.com

https://creplaybook.billrapponline.com/

© 2023-2024 Bill Rapp, Medallion Funds LLC, Director of Capital Advisory